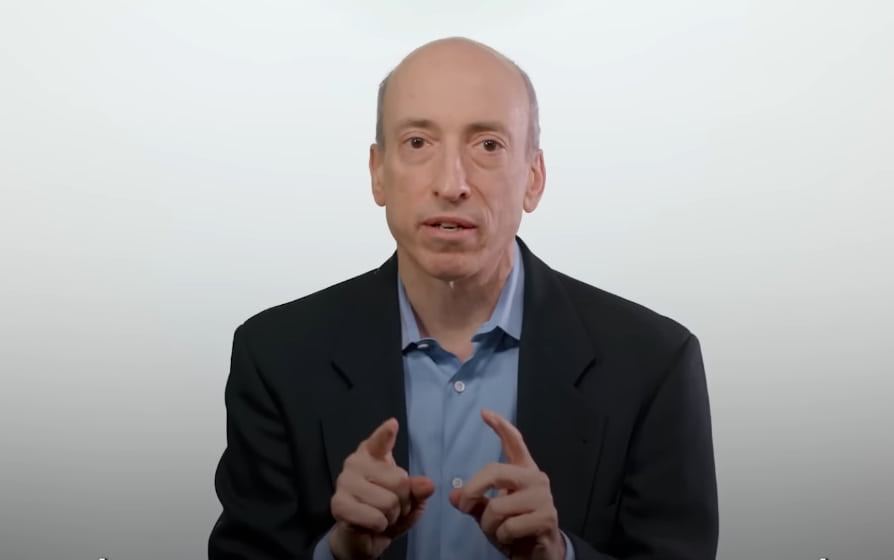

As regulators continue trying to establish control over the cryptocurrency market, the Chair of the United States Securities and Exchange Commission (SEC), Gary Gensler, has testified before the US House of Representatives Financial Services Committee, seemingly circumventing the question on whether Ethereum (ETH) was a security.

Indeed, Patrick McHenry, the chair of the Republican-led Committee, has questioned Gensler on cryptocurrency regulations and climate disclosure rules, telling him to “get comfortable, we’re going to cover a lot of ground today,” Yahoo Finance’s fiscal policy reporter Jennifer Schonberger revealed on April 18.

Dodging the Ethereum question

As it happens, the Committee chair had a lot of questions about the SEC’s approach to regulating crypto, as well as trying to understand whether Gensler views Ethereum, the second largest digital asset, as a commodity or a security after the SEC boss referred to Bitcoin (BTC) as a commodity.

Asked directly by McHenry, “is Ether a commodity or a security?” Gensler tried to dodge the question by arguing that “it depends on the facts and the law and if there’s a group of individuals (…),” to which the Committee chair interrupted him and reiterated that he was asking “about the facts and the law sitting in your seat and the judgment you are making.”

Furthermore, McHenry accused Gensler of refusing to provide clarity to crypto firms on what constitutes a security contract, saying that he was punishing companies for not complying with the law but without providing clear rules. In response, the SEC chair defended his agency’s approach, stating:

“It’s not a matter of lack of clarity. I think this is a field that, in the main, has built up around non-compliance, and that’s the business model they have chosen. Even though it’s not the law, they’ve chosen to be non-compliant and not provide investors with confidence and protections, and it undermines the $100 trillion capital markets.”

According to Schonberger, Gensler said nothing about the crypto markets being incompatible with current securities laws and reiterated that the vast majority of crypto are securities. He says it’s “the law, not a choice. Calling yourself a [decentralized finance (DeFi)] platform is not an excuse to defy securities laws.”

Accusations of incompetence

Additionally, Representative Tom Emmer pointed out that Gensler was the SEC chairman during some of the largest and most widely publicized collapses in the crypto industry, including that of Terra (LUNA) and FTX, with the latter of which, as Emmer highlighted, Gensler had met at least twice before its collapse.

In a video that YouTuber BitBoy Crypto shared on April 19, Emmer further accuses Gensler of incompetence in regulating the crypto space, stating that his “intention to work against the SEC mission and put investors in harm’s way has been made very apparent.”

“Your regulatory style lacks flexibility and nuance, and as a result, you’re been an incompetent cop on the beat, doing nothing to protect everyday Americans and pushing American firms into the hands of the [Communist Party of China (CCP)].”

Earlier, Ron Hammond, Director of Government Relations at the Blockchain Association, announced Gensler’s testimony as one of the major events in a “huge week for crypto policy” after Gensler received a stern letter from McHenry and the Chair of the Oversight and Investigations Subcommittee, Bill Huizenga, regarding the request for records relating to the arrest of crypto exchange FTX founder Sam Bankman-Fried.

Meanwhile, Representative Warren Davidson of Ohio has announced legislation that could see Gensler removed from his position as the SEC chair, as he shared in a tweet published on April 18, accompanied by a video of the hearing.

Watch the video: SEC Chair Gensler tries to dodge the question “is Ether a commodity or a security?”

Featured image via US SEC YouTube.

Leave a Reply